tax liens in georgia for sale

In June 2016 USA Today published an analysis of litigation involving Donald Trump which found that over the previous three decades Trump and his businesses had been involved in 3500 legal cases in US. A federal tax lien exists after.

Over The Counter Sales In Georgia Youtube

If you purchase a home with additional liens on the home such as an unpaid mortgage loan or IRS lien you become responsible for satisfying the debt.

. We have provided several resources to help you make well informed decisions when it comes to investing in tax liens or tax deeds at auction. Cancellation of Liens - The Department will cancel a state tax execution when the delinquent tax liability has been resolved. Set us as your home page and never miss the news that matters to you.

If the tax sale falls on a holiday the sale will take place on the first Wednesday. Zillow has 49 homes for sale in Cairo GA. Tax sales and more specifically tax deed sales are not as complicated as you may first believe.

Are tax liens a good investment. The basic tax rate is 40 percent for the first CHF 10 million of gross gaming revenue. Tax Sale Location Tax sales are held the first Tuesday of each month for the months in which we plan a tax sale on the steps of the Superior Courthouse at Flournoy Park between the hours of 10 am.

Tax lien sale homes and tax deed sale homes. The lien protects the governments interest in all your property including real estate personal property and financial assets. The agencies stopped.

To qualify tax return must be paid for and filed during this period. Obtain a Georgia Title Obtain a Georgia Title. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the.

There are two types of tax sale homes. With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Puts your balance due on the books assesses your.

Following a tax sale any overage of funds known as excess funds is placed in a separate account. Unlimited bets unrestricted number of table games and slot machines. A lien serves to guarantee an underlying obligation such as the repayment of a loan.

Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. Tax sale certificates can provide. If you are new to the tax sale real estate industry we welcome you.

Georgia Sales Tax Due Amount shown on line 6 minus amount shown on line 7. Purchasers Georgia County of Residence. All payments are to be made payable to DeKalb County Tax Commissioner.

Federal and state courts an unprecedented number for a US. Normally if you have equity in your property the tax lien is paid in part or in whole depending on the equity out of the sales proceeds at the time of closing. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

The same applies to tax liens. View and Pay Property Tax Online. Georgia Sales Tax Rate in Purchasers County 6.

The Department will mark an entry of satisfaction on the execution docket and cancel the lien with the Clerk of Superior Court in each county where the lien had been recorded. Also in the event of a foreclosure your tax lien results in you successfully acquiring the property. Tax Sale Listing Office Marker map.

Personal checks business checks 3rd party checks money orders and debitcredit cards will not be accepted if the property has been scheduled for tax sale. In certain cases the lien of another creditor or the interest of an owner may take priority over a federal tax lien even if the NFTL was filed before the other creditors lien was perfected or. At no time can any employee of the Tax Commissioners office provide legal advice.

Both represent sales of homes with unpaid property taxes. A lien is a legal right granted by the owner of property by a law or otherwise acquired by a creditor. Credit From sales tax paid to other state if applicable.

May not be combined with other offers. Offer period March 1 25 2018 at participating offices only. Cash cashiers check ACH or bank wire transfer.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. A tax lien sale is when the liens are auctioned off to. In the end most tax liens purchased at auction are sold at rates between 3 percent and 7 percent nationally according to Brad Westover executive director of the National Tax Lien Association.

With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money. Currently 8 Grand casinos are in operation. Grand casinos holding a type A concession.

Understanding Your Property Tax Bill Property tax bills are available online. The tax may not exceed 80 of the gross gaming revenue and is assigned to the AHVIV fund. If your property is involved in a tax lien levy or tax sale and.

Title Bond Title Bond. Please note the following. 48-4-5 excess funds may be claimed by the record owner of the property at the time of the tax sale by the record owner of each security deed affecting the property and by any other party having any recorded equity interest or claim in such property.

Once scheduled for a tax sale only the following forms of payment are accepted. If the home is being sold for less than the lien amount the taxpayer can request the IRS discharge the lien to allow for the completion of the sale. Tax Due Amount Amount on line 3 multiplied by sales tax rate on line 5.

Subsequent liens taking priority over previously filed federal tax liens. You selected the state of Georgia. With bank deposit account rates at an all-time low tax liens are a great opportunity to get much higher interest rates on your money.

The three major credit reporting agenciesEquifax Experian and TransUnionremoved tax liens from their credit reports as of April 2018. Of the 3500 suits Trump or one of his companies were plaintiffs in 1900. You can potentially hit the jackpot with.

Below is information regarding tax liens and the levy and tax sale process. Register to attend the auction.

Property Tax Sale Today At Candler County Courthouse Metteradvertiser Com

Complete List Of Tax Deed States

One Acre In Georgia Almost 4 000 Square Feet Has Elevator 199 000 The Old House Life

Tax Sale Listing Dekalb Tax Commissioner

279 Highland Boulevard Brooklyn Ny 11207 Propertyshark Com Highland House Styles Future House

Riverside Ca Tax Deed Online Auction Review 700 Properties Homes Condos Land Youtube

Pitfalls For The Inexperienced Georgia Tax Lien Investor Kim Bagwell Llc

Tax Sale Listing Dekalb Tax Commissioner

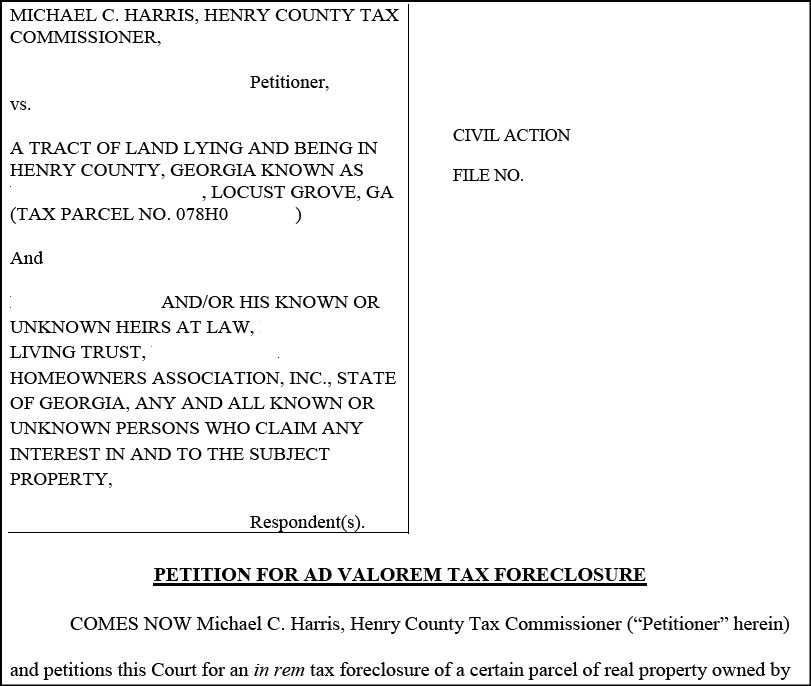

Judicial In Rem Tax Sales Gomez Golomb Law Office

Tax Sale Listing Dekalb Tax Commissioner

Delinquent Tax Douglas County Tax

What Is A Tax Sale Property And How Do Tax Sales Work Home Buying Sale House Real Estate

Pin On Historical Homes That Are For Sale

Just Reduced Gorgeous Converted Bus W New Engine Converted Bus For Sale In Tampa Florida Tiny House Listings

Tax Sale Listing Dekalb Tax Commissioner