oklahoma franchise tax instructions

To file your Annual Franchise Tax by Mail. On the Oklahoma Tax Commission website go to the Business Forms page.

Oklahoma Corporate Income Tax Forms And Instructions

Get the tax answers you need.

. Scroll down the page until you find Oklahoma Annual Franchise Tax. For a corporation that has elected to change its filing period to match its fiscal year the. Corporations not filing Form.

9AM - 5PM MON TO FRI. Talk to a 1-800Accountant Small Business Tax expert. Mine the amount of franchise tax due.

Paper returns without a 2-D barcode should be mailed to the Oklahoma Tax. Talk to a 1-800Accountant Small Business Tax expert. Oklahoma Annual Franchise Tax Return Revised 8-2017 FRX 200 Dollars Dollars Cents Cents 00 00 00 00 00 00 00 00 00 00 00 The information contained in this return and any.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. The franchise excise tax is levied and assessed at the rate of 125 per 1000 or fraction thereof on the amount of capital used in-vested or. Late payments of franchise tax 100 of the franchise tax liability must be paid with the extension.

The franchise tax is waived for revenue and assets of less than 200000 and is capped at 20000. Get the tax answers you need. Complete Edit or Print Tax Forms Instantly.

Oklahoma franchise tax is due and payable each year on July 1. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Fill Sign Email OK Form 200 More Fillable Forms Register and Subscribe Now.

To make this election file Form 200-F. Corporations not filing Form 200-F must file a stand-alone Oklahoma Annual Franchise Tax Return Form 200. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return.

To make this election file Form 200-F. Mailing Instructions Please mail your completed return officer information and payment to Oklahoma Tax Commission Franchise Tax PO. Includes Form 512 and Form 512-TI 2012 Oklahoma Corporation Income Tax Forms and Instructions This packet contains.

Oklahoma Franchise Law and Registration Franchising a Business. Franchise Tax Payment Options New Business Information New Business Workshop Forming a Business in Oklahoma Streamlined Sales. Corporations that remitted the.

Ad Find out what tax credits you might qualify for and other tax savings opportunities. File the annual franchise tax using the same period and due date of their corporate income tax filing year or File the annual franchise tax on the Oklahoma Corporate Income Tax Form. Ad Register and Subscribe Now to work on your OK Form 200 more fillable forms.

Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. When is franchise tax due. To make this election file Form 200-F.

Ad Access Tax Forms. The maximum annual franchise tax is 2000000. Instructions for completing the Form 512 512.

Ok Frx 200 2020 2022 Fill Out Tax Template Online Us Legal Forms

Why Do You Need To Hire Employment Lawyer In 2022 Family Law Attorney Attorney At Law Family Law

California Llc Vs S Corp A Complete Guide Windes

Www Ispfsb Com Login To Your Ispfsb Online Account

Godzilla Monster S Inc By Roflo Felorez On Deviantart

Can T File Your Tax Return By Midnight Here S How To File A Tax Extension Cnet

Earned Income Tax Credit Now Available To Seniors Without Dependents

Account Id And Letter Id Locations Washington Department Of Revenue

/hrblock_logo1-c3a5cbb43e1245aabb0e7d9b5df074ae.jpg)

The 5 Best Tax Preparation Services Of 2022

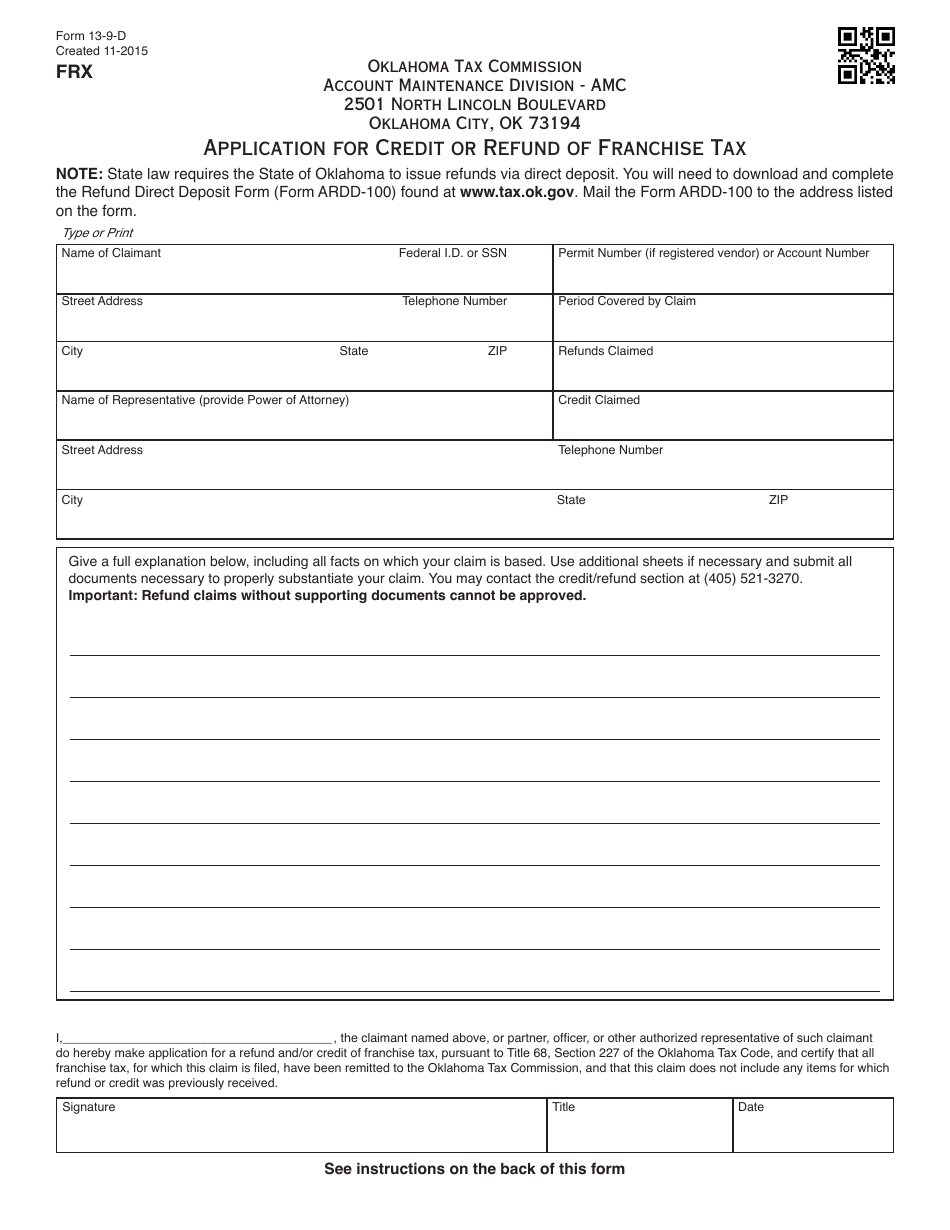

Otc Form 13 9 D Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

The Best Guide To Paying Quarterly Taxes Everlance

Www Ispfsb Com Login To Your Ispfsb Online Account

Corporation Income Tax Forms And Instructions Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Oklahoma Corporate Income Tax Forms And Instructions

/cloudfront-us-east-1.images.arcpublishing.com/gray/CRS4LTHQTJECPKOIW7B4734K4I.jpg)

N C Is Finally Ready To Accept Your State Returns As The 2022 Tax Season Officially Opens

:max_bytes(150000):strip_icc()/EYTaxChat-60073cdaa3df4583a27a1794b6d18b6f.jpg)